文章详情

Tbquant机器学习KNN预测器使用方法及示例

松鼠Quant

2025-11-26

工具推荐

『正文』

ˇ

Params Numeric BollLength(20); Numeric BollOffset(2.0); Numeric ScoreThreshold(0.65); // ML置信度阈值 Numeric Fund(100000);

Vars // 基础指标 Series<Numeric> ATR; Series<Numeric> BollMid; Series<Numeric> BollUpper; Series<Numeric> BollLower; Series<Numeric> BollWidth; Series<Numeric> BollPosition;

// 7个特征(需要策略自己计算) Series<Numeric> Feature1; // 趋势强度 Series<Numeric> Feature2; // 综合动量 Series<Numeric> Feature3; // 波动率 Series<Numeric> Feature4; // 成交量强度 Series<Numeric> Feature5; // BOLL位置 Series<Numeric> Feature6; // BOLL收缩度 Series<Numeric> Feature7; // 反转信号

// ML预测结果(从KNN_Predictor获取) Series<Numeric> MLSignal; // 预测信号 Numeric Confidence; // 预测置信度 Series<Numeric> MLConfidence; // 预测置信度

// 辅助变量 Series<Numeric> MAFast; Series<Numeric> MASlow; Series<Numeric> ADXValue; Series<Numeric> ROC; Series<Numeric> RSIValue; Series<Numeric> MACD; Series<Numeric> VolumeRatio; Series<Numeric> Lots;

Events

onBar(ArrayRef<Integer> indexs) { // 计算手数 Lots = Max(1, Round(Fund / (O * ContractUnit * BigPointValue * MarginRatio / Rollover), 0));

// ==================== 计算基础指标 ==================== ATR = AvgTrueRange(14); BollMid = Average(Close, BollLength); Numeric BollBand = StandardDev(Close, BollLength, 2); BollUpper = BollMid + BollOffset * BollBand; BollLower = BollMid - BollOffset * BollBand; BollWidth = IIF(BollMid != 0, (BollUpper - BollLower) / BollMid, 0); BollPosition = IIF((BollUpper - BollLower) != 0, (Close - BollLower) / (BollUpper - BollLower), 0.5);

// ==================== 计算7个特征 ====================

// Feature1: 趋势强度 MAFast = Average(Close, 10); MASlow = Average(Close, 30); Numeric TrendStrength = Abs(MAFast - MASlow) / Close; Numeric PDI = Average(Max(High - High[1], 0), 14) / ATR * 100; Numeric MDI = Average(Max(Low[1] - Low, 0), 14) / ATR * 100; Numeric DX = IIF((PDI + MDI) != 0, Abs(PDI - MDI) / (PDI + MDI) * 100, 0); ADXValue = Average(DX, 6);

if (MAFast > MASlow) { Feature1 = TrendStrength * (ADXValue / 100); } else { Feature1 = -TrendStrength * (ADXValue / 100); }

// Feature2: 综合动量 ROC = (Close - Close[5]) / Close[5] * 100; Numeric Up = Max(Close - Close[1], 0); Numeric Down = Max(Close[1] - Close, 0); Numeric RSValue = IIF(Average(Down, 14) != 0, Average(Up, 14) / Average(Down, 14), 0); RSIValue = IIF(RSValue != 0, 100 - (100 / (1 + RSValue)), 50); MACD = Average(Close, 12) - Average(Close, 26);

Feature2 = ROC * 0.5 + (RSIValue - 50) * 0.5 + (MACD / Close * 100) * 0.3;

// Feature3: 波动率 Feature3 = (ATR / Close) * 100;

// Feature4: 成交量强度 VolumeRatio = Vol / Average(Vol, 20); Feature4 = VolumeRatio; // 简化版,实际可加OBV

// Feature5: BOLL位置 Feature5 = BollPosition;

// Feature6: BOLL收缩度 Feature6 = IIF(BollWidth != 0, 1.0 / (BollWidth * 100), 10);

// Feature7: 反转信号(简化版) Numeric BollExtreme = 0; if (BollPosition < 0.1 || BollPosition > 0.9) { BollExtreme = 0.3; } Numeric RSIExtreme = 0; if (RSIValue < 30 || RSIValue > 70) { RSIExtreme = 0.3; } Feature7 = Min(BollExtreme + RSIExtreme, 1.0);

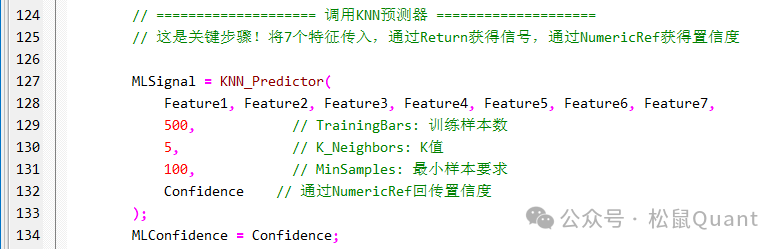

// ==================== 调用KNN预测器 ==================== // 这是关键步骤!将7个特征传入,通过Return获得信号,通过NumericRef获得置信度

MLSignal = KNN_Predictor( Feature1, Feature2, Feature3, Feature4, Feature5, Feature6, Feature7, 500, // TrainingBars: 训练样本数 5, // K_Neighbors: K值 100, // MinSamples: 最小样本要求 Confidence // 通过NumericRef回传置信度 ); MLConfidence = Confidence;

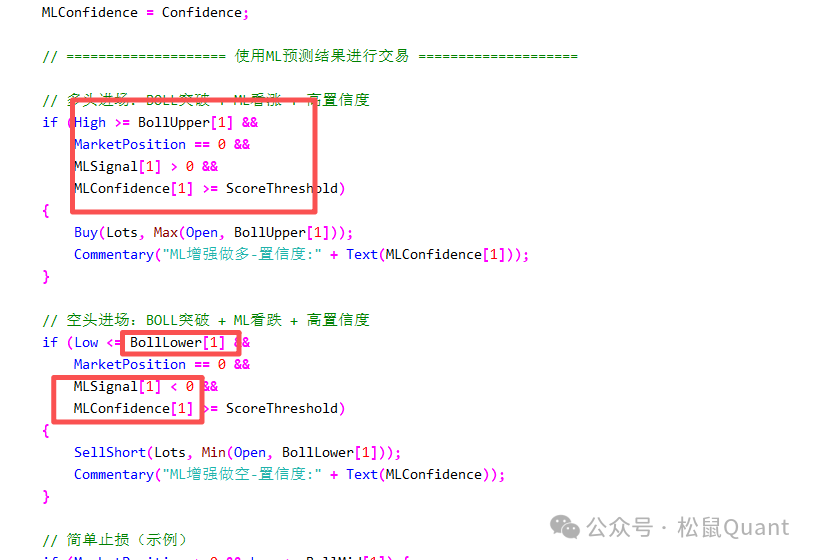

// ==================== 使用ML预测结果进行交易 ====================

// 多头进场:BOLL突破 + ML看涨 + 高置信度 if (High >= BollUpper[1] && MarketPosition == 0 && MLSignal[1] > 0 && MLConfidence[1] >= ScoreThreshold) { Buy(Lots, Max(Open, BollUpper[1])); Commentary("ML增强做多-置信度:" + Text(MLConfidence[1])); }

// 空头进场:BOLL突破 + ML看跌 + 高置信度 if (Low <= BollLower[1] && MarketPosition == 0 && MLSignal[1] < 0 && MLConfidence[1] >= ScoreThreshold) { SellShort(Lots, Min(Open, BollLower[1])); Commentary("ML增强做空-置信度:" + Text(MLConfidence)); }

// 简单止损(示例) if (MarketPosition > 0 && Low <= BollMid[1]) { Sell(0, Min(Open,BollMid[1])); Commentary("多头止损"); }

if (MarketPosition < 0 && High >= BollMid[1]) { BuyToCover(0, Max(Open,BollMid[1])); Commentary("空头止损"); }

// 显示ML信号 PlotNumeric("MLSignal", MLSignal[1]); PlotNumeric("MLConfidence", MLConfidence[1]); PlotNumeric("ScoreThreshold", ScoreThreshold); }

//------------------------------------------------------------------------// 编译版本: 2025/11/21// 版权所有: songshu// // 使用说明:// 1. 确保KNN_Predictor.txt用户函数已编译// 2. 本策略只需计算7个特征,其他交给KNN函数// 3. 可以将此模式复制到任何策略中使用//// 调用方式:// MLSignal = KNN_Predictor(Feature1-7, TrainBars, K, MinSamp, MLConfidence);// Return返回值:信号 (1=看涨, -1=看跌, 0=中性)// MLConfidence:通过NumericRef回传的置信度 [0,1]//------------------------------------------------------------------------

用户函数会把指标归一化、每个BAR生成信号和置信度。需要注意的是返回的信号和置信度需要前推使用,如下:

防迷路

微 信|小松鼠-松鼠Quant

微信号|viquant01

分享